Your Roof Isn't Old—It's a Ticking Time Bomb

That small leak? It's not going away. It's getting worse. Every storm, every gust of wind, every cracked shingle is silently destroying your home's value—and draining your wallet in repairs, heating, and stress. Seniors across America are taking action and getting up to 75% off a complete roof replacement. But most wait too long — until water's pouring in and options are gone.

Benefits:

- ✅ Stop leaks before they spiral into $10k+ disasters

- ✅ Slash heating and cooling costs

- ✅ Keep your home dry, warm, and protected

Outdated Flooring Can Send You to the ER

Worn-out carpet. Cracked tiles. Slippery vinyl. If you're over 60, your flooring could be your biggest fall risk—and the #1 reason for injury-related hospital stays. Fix it now, or pay later in surgery, rehab, or worse.

Benefits:

- ✅ Safer surfaces = fewer fall risks

- ✅ Low-maintenance upgrades that actually look good

- ✅ Boost your home's value by tens of thousands

One Misstep in the Bathroom Can Change Everything

A slippery floor. A high tub edge. One fall, and life as you know it is over. Medical bills, rehab, loss of independence. That's why seniors are rushing to upgrade their bathrooms before it's too late.

Benefits:

- ✅ Walk-in tubs & safety rails

- ✅ Anti-slip flooring

- ✅ Shower-to-bath conversions

Your Windows Are Bleeding Cash—Every Single Month

Drafty windows aren't just annoying. They're a money pit. Every winter chill and summer scorch is costing you comfort, safety, and thousands in energy bills. You're heating the whole damn neighborhood—and your wallet shows it.

Benefits:

- ✅ Cut energy bills instantly

- ✅ Improve insulation and comfort

- ✅ Add modern style + boost home resale value instantly

Still Paying Full Price for Auto Insurance? You're Getting Ripped Off.

If you're over 60 and haven't checked your rate in the last year, you're probably overpaying. Some seniors are cutting their bills in half—without changing cars or coverage. You're not loyal. You're being punished.

Benefits:

- ✅ Save up to 40% instantly

- ✅ Same car. Same coverage. Way less cost.

- ✅ Policies start under $30/mo

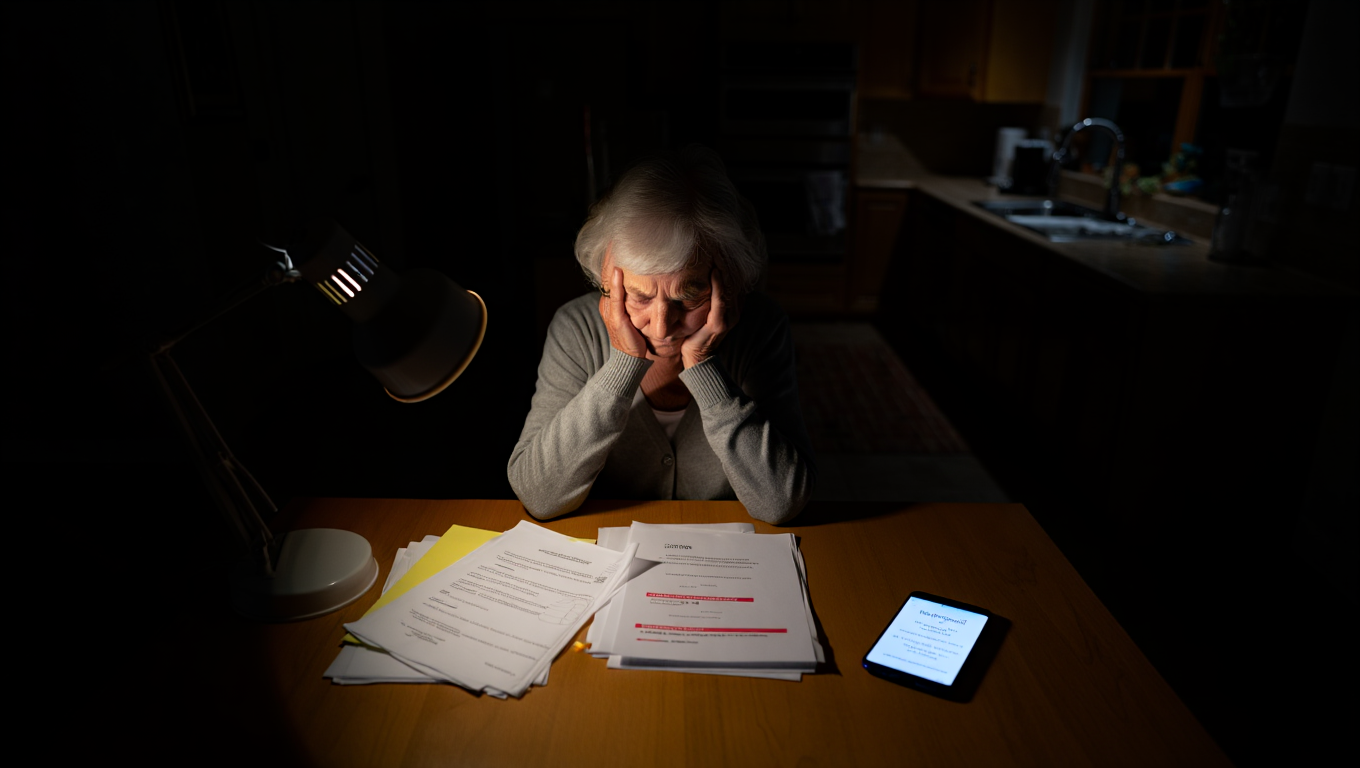

You're Sitting on a Pile of Cash—While Bills Pile Up

You worked decades for this home. Now it's time for it to pay you back. Releasing even a fraction of your home's equity could erase credit card debt, fund major repairs, or finally give you breathing room. Because struggling on a fixed income while you own a $300,000 asset is insanity.

Benefits:

- ✅ Pay off high-interest debt

- ✅ Fund home improvementsor retirement plans

- ✅ Rates at historic lows

Medicare Doesn't Cover Enough—And It's Costing You More Than You Think

You've got Medicare… but your dental? Not covered. Hearing aids? Too expensive. Vision? You're on your own. That's why more and more seniors are adding extra coverage that fills in the cracks—before those cracks drain their savings.

Benefits:

- ✅ Covers what Medicare leaves out (like dental, vision & more)

- ✅ Get $1,000+ in extra benefits like groceries

- ✅ No surprise bills at the worst possible time

Need Cash? Seniors Are Getting Approved for Loans Others Can't

You've paid your dues. But try getting help from a bank and suddenly you're invisible. Whether it's credit cards, emergencies, or just breathing room you need—there are loan offers out there designed specifically for seniors. Even on fixed income. Even without a job.

Benefits:

- ✅ Fast approval

- ✅ No collateral needed

- ✅ Flexible terms to fit your lifestyle

One Broken Appliance Can Wreck Your Month. Maybe Your Year.

Your fridge dies. The heater goes out. The washing machine floods the floor. Seniors on fixed income can't afford surprise repair bills—and without a home warranty, you're one breakdown away from total chaos.

Benefits:

- ✅ Protect appliances, systems, and sanity

- ✅ Avoid $1,000+ emergency repair bills

- ✅ 24/7 service with trusted pros

Most Seniors Are Overpaying for Home Insurance—Are You One of Them?

Your current provider is betting you'll never check your rate. Meanwhile, your neighbor is paying half as much for better coverage. Thousands are switching to senior-smart insurance policies that actually make sense.

Benefits:

- ✅ Better coverage for less money

- ✅ No upsells. No nonsense. Just protection

- ✅ Bundles available for even deeper savings